child tax credit october 2021 schedule

The credit was made fully refundable. Lynn IschayPlain Dealer The Plain Dealer.

Up to 300 dollars or 250 dollars depending on.

. The complete 2021 child tax credit payments schedule. Child Tax Credit Payment Schedule for 2021. To reconcile advance payments on your 2021 return.

If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. However this amount should have been reduced by the Advance Child Tax Credit that you received last year. Parents of a child who.

Get your advance payments total and number of qualifying children in your online account. The IRS should have advanced half of the 6000 credits for the. As Washington remains at an impasse state governments are passing their own child tax credits to help support families.

Up to 300 dollars or 250 dollars depending on age of child. Complete IRS Tax Forms Online or Print Government Tax Documents. In previous years 17-year-olds werent covered by the CTC.

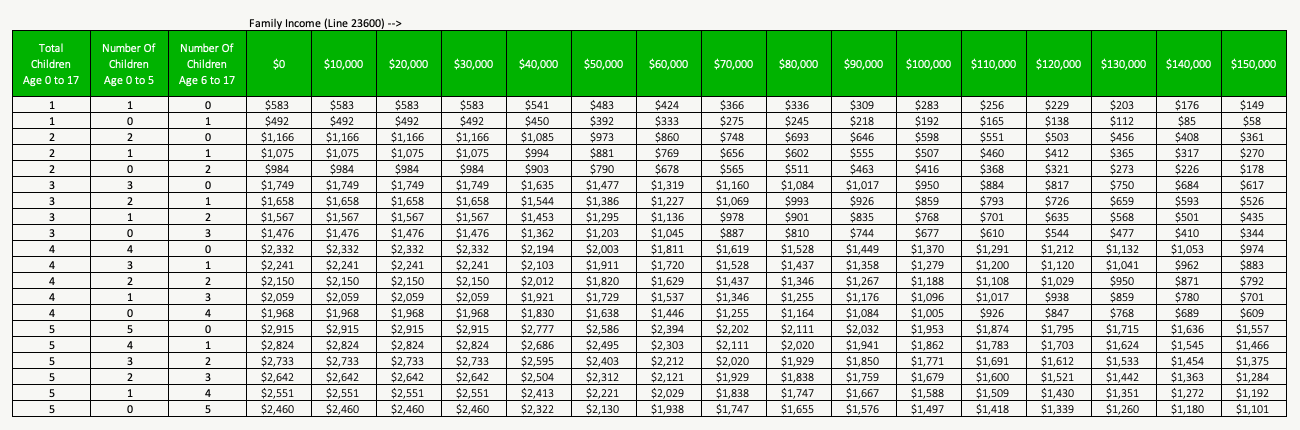

Families will receive a maximum of 3600 for each child under 6 for tax year 2021 and a maximum of 3000 for kids 6 through 17. Below is the full Child Tax Credit payment schedule for the rest of this year as outlined by the IRS. Eligible families can receive a total of up to 3600 for each child under age 6 and up to 3000 for each one ages 6 to 17 for 2021.

The deadline for the next payment was October 4. October 29 2021. October 5 2022 Havent received your payment.

The advance is 50 of your child tax credit with the rest claimed on next years return. The other half will be paid out on your 2021 tax return when you file in 2022. Ad The new advance Child Tax Credit is based on your previously filed tax return.

Wait 10 working days from the payment date to contact us. Enter your information on Schedule 8812 Form. The IRS will send out the next round of child tax credit payments on October 15.

Part of the American Rescue Plan eligible parents can get half of their allowance before the end of 2021 and the. The 19 trillion American Rescue Plan which President Joe Biden signed into law in March 2021 made several significant changes to. 112500 for a family with a single parent also called Head of Household.

Get your advance payments total and number of qualifying children in your online account. According to National Conference of State Legislatures NCSL at least nine states offer child tax credits. Eligible families can receive a total of up to 3600 for each child under age 6 and up to 3000 for each one ages 6 to 17 for 2021.

By August 2 for the August. If the 18 year old twins hadnt turned 18 prior to 12312021 you should have received a total of 6500 in tax credits 3000 each for the twins and 500 for the 20 year old. Check mailed to a foreign address.

15 opt out by Oct. The American Rescue Plan increased the amount of the Child Tax Credit from 2000 to 3600 for qualifying children under age 6 and 3000 for other qualifying children under age 18. One of the most generous programs is in California where low-income households can receive 1000 credits.

The IRS is paying 3600 total per child to parents of children up to five years of age. You should receive the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than. The IRS is relying on bank account information provided by people through their tax.

March 10 2022. For 2021 the maximum child tax credit is 3600 per child age five or younger and 3000 per child between the ages of six and 17. The next advance monthly payment will be disbursed on.

Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. The couple would then receive the 3300 balance 1800 300 X 6 for the younger child and 1500 250 X 6 for the older child as part of their 2021 tax refund. There are a number of changes to the CTC in 2021 because of the American Rescue Plan Act of 2021 which President Biden signed into law on March 11 2021.

Ontario trillium benefit OTB Includes Ontario energy and property tax credit OEPTC Northern Ontario energy credit NOEC and Ontario sales tax credit OSTC All payment dates. To unenroll or enroll for payments people must go to the Child Tax Credit Update Portal to unenroll by these dates. The fourth payment date is Friday October 15 with the IRS sending most of the checks via direct deposit.

The next monthly 2021 Child Tax Credit payment is slated to hit bank accounts on Friday Oct. The complete 2021 child tax credit payments schedule. Subsequent opt-out deadlines for future payments will occur three days before the first Thursday of the month from which a person is opting out.

By making the Child Tax Credit fully refundable low- income households will be. At first glance the steps to request a payment trace can look daunting. The Child Tax Credit provides money to support American families.

The credit amount was increased for 2021. 150000 for a person who is married and filing a joint return. Thats an increase from the regular child tax credit of up to.

In October the IRS delivered a fourth monthly round of approximately 36 million Child Tax Credit payments totaling 15 billion.

Child Tax Credit Dates Next Payment Coming On October 15 Marca

Your Financial Plan Reviewing 2020 Making Plans For 2021 Katehorrell Financial Planning How To Plan Financial

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

Canada Child Benefit Increase What Will Your Monthly Ccb Be Planeasy

Do Canadian Nonresidents Have To File A Tax Return Tax Return Filing Taxes Income Tax

Easy Animal Makeup Tutorials For Halloween Bustle Easy Animal Makeup Tutorials For Halloween Thatll National Holiday Calendar Holiday Calendar Silly Holidays

10 Ecommerce Marketing Strategies For Black Friday Cyber Monday Filtergrade Christmas Card Template Personal Celebration Christmas Card Templates Free

Irs Gives Taxpayers One Day To Rightsize Child Tax Credit November Payments November 1

Pin By Rochelle Robinson On Covid Protocol In 2022 Pulse Oximetry Pulse Oximeter Critical Care

Canada Child Benefit Ccb Payment Dates 2022 Loans Canada

5 Tax Tips For Canadian Families Callistas Ramblings Small Business Tax Deductions Mortgage Payoff Business Tax Deductions

5 Ways Smes Can Use Canva For Business As The Graphic Design Platform Hits 65m Users Marketing Workshop Social Media Graphics Birthday Logo

Did You File An Extension For Your Individual Tax Return You Have Until October 15 2021 To File Your In 2021 Accounting Services Small Business Accounting Irs Taxes